This is an update of an article originally published on 4 September 2015. The updates refer to the depreciation of sterling following the Brexit referendum and small changes in how the platforms function.

One of the great things about being a freelance translator is that you can work for clients in different countries. Since I started out over a decade ago, I have worked for clients in Spain, France, Switzerland, the UK, the Republic of Ireland, the United States, Canada, Sweden, Austria, China, South Korea, Israel and Guatemala.

All translators can benefit from finding clients in other countries. But the crash in the value of the pound sterling following the Brexit vote makes this a particularly good time for UK-based translators to seek foreign-based clients.

How easy is it to get paid by a client in a country that uses a different currency?

The most obvious solution is an international bank transfer. But anybody who has done one before knows that banks charge hefty commission and fees. Some banks claim that they charge no fees, but in reality, their fee is hidden in the poor exchange rate they give you.

Many translators use Paypal or Skrill, but they too take a huge chunk of the pie and give poor exchange rates. The transaction fees can easily amount to more than 5%, which could cost you many hundreds of euros or pounds over a year, perhaps even thousands.

So, what other options are available?

The free solution

If you have a bank account in your client’s country, you could try to to find somebody you know and trust who wants to transfer money in the other direction and transfer money into each other’s bank account.

Example: Jim lives in the UK but also has a French bank account. He works for a German client who pays €1,000 into Jim’s French account. Jim needs to transfer the money to the UK.

Lee lives in Spain but also has a UK bank account. He works for a British client who transfers £1,000 into Lee’s UK account.

Jim and Lee agree to exchange money. Jim transfers €1,000 from his French account to Lee’s Spanish account. Meanwhile, Lee checks the official exchange rate (€1 = £0.7315 at the time of writing) and transfers £731.50 into Jim’s UK account.

Result: Jim has most of the money he earned in his UK account (the rest he can transfer another time, or use for online purchases or while on holiday), and Lee has all his money in his Spanish account.

The cheap solutions

Unfortunately, you can’t always find somebody who wants to transfer a similar amount of money in the opposite direction to you, but that’s where peer-to-peer (P2P) systems help.

P2P systems like CurrencyFair and TransferWise automatically match you with somebody transferring money in the opposite direction, and charge only a very small percentage in commission. TransferWise will take a fee of only 0.5%; CurrencyFair takes just 0.15%.

Of the two, TransferWise tends to be cheaper for smaller payments (less than £7,000), since CurrencyFair charges a £3/€3 withdrawal fee. However, you don’t have to withdraw money from CurrencyFair immediately, so you don’t have to pay £3/€3 on every payment you receive, but only on each withdrawal.

On the face of it, TransferWise sounds better for most freelance translators, but I actually prefer CurrencyFair. Some of the reasons why I prefer CurrencyFair are explained here, but one reason not mentioned is that to get paid with TransferWise, your client must have a TransferWise account; CurrencyFair, on the other hand, accepts payments from anyone.

(Update: TransferWise has now introduced a “borderless” account that gives you a proper bank account number in various countries. Read more at this blog post.)

Using CurrencyFair

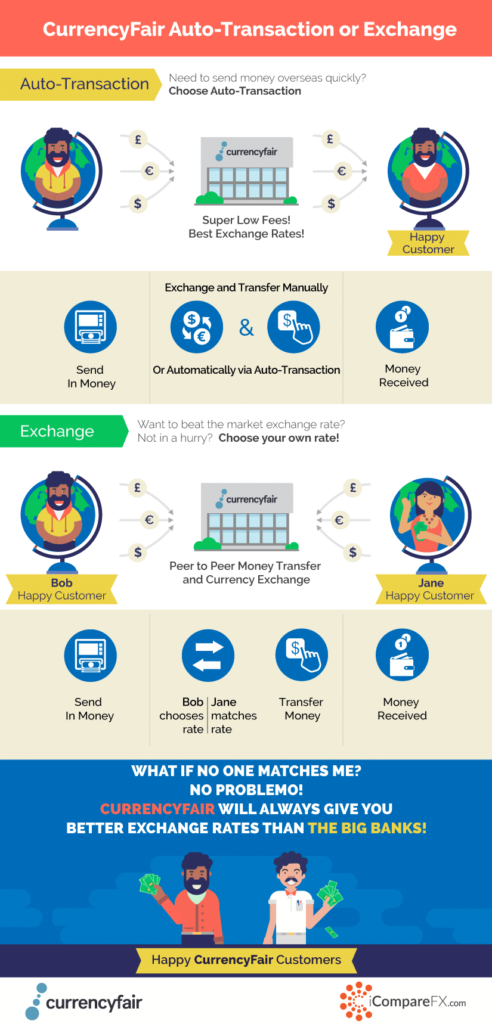

Infographic provided by iCompareFX.com

Getting paid with CurrencyFair if you have a bank account in the client’s currency:

- Give your client the bank details of your account in the client’s currency.

- Once the money has cleared, log in to CurrencyFair, click on “Deposit” and add a pending deposit.

- When logged in, click on “CurrencyFair Bank Accounts” to find out the details of CurrencyFair‘s account in the currency in which you were paid.

- Make the payment to CurrencyFair using your online banking service, making sure you include the reference number provided by CurrencyFair for your account.

- Wait for the e-mail confirming that the funds are uploaded and available in your CurrencyFair account.

- Log in to your account and make a transfer using either the QuickTrade system (it gives you the best exchange rate currently offered by somebody exchanging money in the other direction) or, to save even more money, the Marketplace, where you can state the exchange rate you want and wait for somebody to accept it.

- Transfer the funds to your account in your home country.

Getting paid with CurrencyFair if you don’t have a bank account in the client’s currency:

- Log in to CurrencyFair and click on “Deposit” to add a pending deposit.

- You probably won’t have your client’s bank details. Simply write “NA” in any boxes for which you have no information. CurrencyFair will still recognise the payment based on the amount and the reference number.

- Put CurrencyFair’s account details for the client’s currency on your invoice and your customer reference number. Make it clear to the client that they must use this reference number when making the transfer. (NB One of my clients forgot this, but I e-mailed the client’s receipt for the transfer to CurrencyFair and they credited my account within 24 hours, so no need to worry too much if they forget.)

- Wait for the e-mail confirming that the funds are uploaded and available in your CurrencyFair account.

- Log in to your account and make a transfer using either the QuickTrade system (it gives you the best exchange rate currently offered by somebody exchanging money in the other direction) or, to save even more money, the Marketplace, where you can state the exchange rate you want and wait for somebody to accept it.

- Transfer the funds from CurrencyFair to your account in your home country.

Getting paid in USD

Unfortunately CurrencyFair no longer has an account in USD and is not able to accept users based in the United States. For USD I would therefore recommend always using TransferWise. However, please note that your client must open a TransferWise account in order to pay you, so it’s probably not a viable solution if you’re working for a large company. With TransferWise, the client logs in and makes the payment, which is then automatically converted to your currency and transferred straight into your bank account in your home country.

WeSwap

WeSwap is totally different to the other two services. It is not suitable for getting paid, as funds can only be uploaded from one account owned by you in your home country. However, I’ve included it anyway as it’s a great way to make online purchases (Google charges in USD, so I use WeSwap). It also allows you to save money on currency exchange while travelling, while avoiding carrying around lots of cash.

WeSwap is only available to persons resident in the United Kingdom, Denmark, France, Germany, Ireland, Italy, the Netherlands, Norway, Spain or Sweden.

With WeSwap, after you set up an account you will be sent a pre-pay debit card (Mastercard) through the post. You can then load funds on to the card by bank transfer or using an ordinary debit card, and then you can convert those funds into another currency on the website.

The conversion is done at the mid-market rate, and the commission is just 1.4% if you need an immediate conversion, 1.3% if you are willing to wait up to 3 days, or 1.0% if you can wait a week.

Once your money is converted, you can spend it in the country you are visiting (or for online purchases), either using the card for card payments in stores (always free), or by withdrawing money from a cash machine (free for withdrawals of at least £200, €250 or equivalent).

I like to upload my funds a few weeks before travelling so that I can buy tickets for events and domestic transport in advance, since the 1.0% fee is cheaper than what your bank will charge you for using your credit card (you won’t see commission on your statement, but it will be hidden in the exchange rate they give you).

Currencies supported: CurrencyFair (open drop-down list), TransferWise, WeSwap

Fees: CurrencyFair, TransferWise, WeTransfer

Special offers

If you decide to sign up for these excellent services, please use the links provided below, as by using them both you and I will benefit from a special offer.

CurrencyFair: If you use this link, once you have transferred the equivalent of €400 we will both receive €30.

TransferWise: If you use this link, you will receive a free transfer for up to £500. For every 3 people who sign up, I will receive £50.

WeSwap: If you use this link, you’ll get £5 free credit and I’ll get £10.

Good article on the ins and outs of foreign currency payments by my colleague Timothy Barton: well worth a read

http://t.co/9BgnI2M78n

@inspirex @owaisz This might be useful for you. http://t.co/x1vP12IGkW

RT @anglopremier: Getting paid in foreign currencies wtihout paying huge bank fees! #xl8 #t9n #freelancing #freelancers

I can suggest an alernative to all the above mentioned solutions. If

you use Foreign Exchange brokers you end up paying smaller fees and

enjoy much improved exchange rates.

The method is simple.

You

supply your employer with the bank details of the broker so they can be

paid directly (removing the need for you to open an account in the

respective currency, saving on any monthly fees). Once received the

foreign exchange broker will then forward the GBP equivelant to your GBP

account.

I am a foreign exchange broker for a company called

SGM-FX and we help many people in this way. If you have any interest in

the above I would be more than happy to explain this in much more

detail.Please contact me via email – tom@sgm-fx.com

A broker can be cheaper, but for large payments in the thousands. For smaller payments, it will often be more expensive.

Please note there are no monthly fees for using CurrencyFair or TransferWise. Also, in many countries, including the UK, you can have a bank account without paying monthly fees.

RT @METMeetings: MET Council member @anglopremier on the ins & outs of getting paid in foreign currencies https://t.co/usu9KUW1Cr #METblogg…

MET Council member @anglopremier on the ins & outs of getting paid in foreign currencies https://t.co/uY5ibME5bK #METblogger

Hi, this still doesn’t answer the question of what to do if your client pays in USD as you state TransferWise, CurrencyFair and WeSwap cannot accept USD payments (well TransferWise can if your client has a TransferWise account – but its not easy to get major clients to open an account just for me) – so what is the solution to accept USD from clients (and I do not know anybody I could trust to use their US account)?

Hi Will. I’m afraid I don’t have a great solution. I always used to use CurrencyFair until they closed their US dollar account. Since then, I used TransferWise with one client, but that was a translator who I could convince to open an account. If you’re working for a large company then, as you point out, the person you’re in contact with won’t have the authority to open a TransferWise account.

You can still receive USD payments with CurrencyFair (I’ll edit the text to make it clearer), but since the account is not based in the US, there would be charges of around $50-60. This might still be the cheapest solution for large payments, and if you have a regular client, it might be an idea to let lots of jobs accumulate before invoicing.

I have read online of people who have opened an account in the US and spend the money they earn using a debit card. However, you have to be physically present to open an account. If you plan to visit the US at some point, it might be an idea to look into it.

If you find any better solutions, please let us know on here.

RT @METMeetings: MET Council member @anglopremier on the ins & outs of getting paid in foreign currencies https://t.co/usu9KUW1Cr #METblogg…

Getting paid in foreign currencies https://t.co/bJNrssywQJ by @anglopremier

RT @ata_tcd: Getting paid in foreign currencies https://t.co/bJNrssywQJ by @anglopremier

Pingback: Weekly translation favorites (Aug 19-25)

Getting paid in foreign currencies https://t.co/22BzrkDO7G

Getting paid in foreign currencies https://t.co/ghLMXFyKIS by @anglopremier